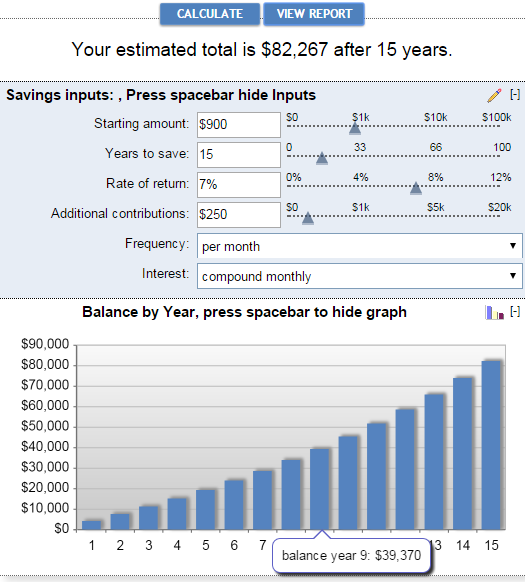

Investment calculator with increasing contributions

Movements in exchange rates may cause the value of underlying international investments to go up or. Use the calculator below to estimate your projected retirement income and how much contributions you need to make per month to achieve your retirement goals.

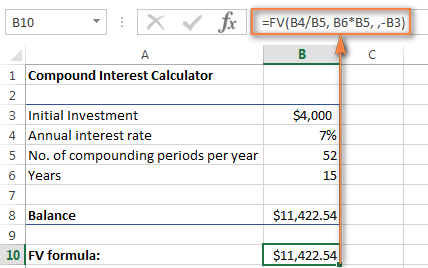

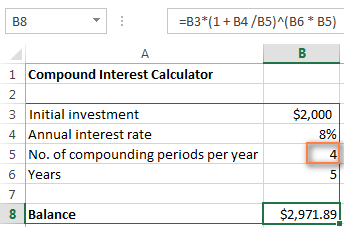

Compound Interest Formula And Calculator For Excel

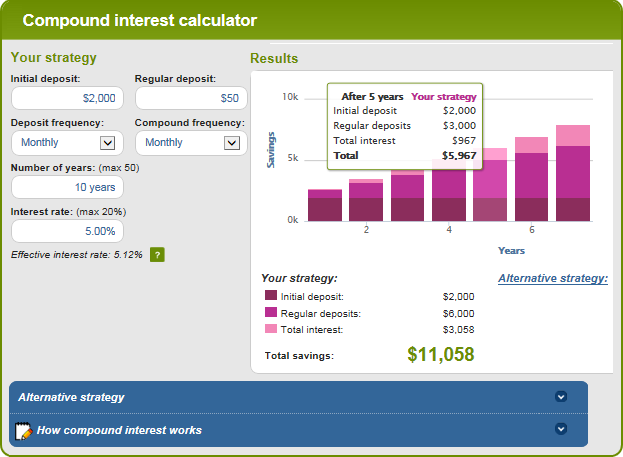

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

. The amount you contribute investment performance and your savings timeframe are some factors that affect the future value of your TFSA. It is the basis of everything from a personal savings plan to the long term growth of the stock market. 457 Plan Roth Conversion with Distributions Calculator.

Also pre-tax contributions are subject to the. See about increasing your 401k contributions. Should I adjust my payroll withholdings.

Use the TAP Annuity Estimator calculator or contact the Plan 3 record keeper. Allan Gray does not guarantee the suitability or potential value of any information or particular investment source. Find out more about your tax relief and pension allowances.

Compare taxable tax-deferred and tax-free investment growth. Years invested 65 minus your age. Apart from this Rest does not have any relationships or associations with any related body corporate or product issuer that might reasonably be expected to be capable of influencing any advice.

Will my investment interest be deductible. The big difference between traditional IRAs and Roth IRAs is when taxation is applied. The formers contributions go in pre-tax usually taken from gross pay very similar to 401ks but are taxed upon withdrawal.

Where applicable any fund rules the contractual terms or fund rules will prevail. The following restrictions apply. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

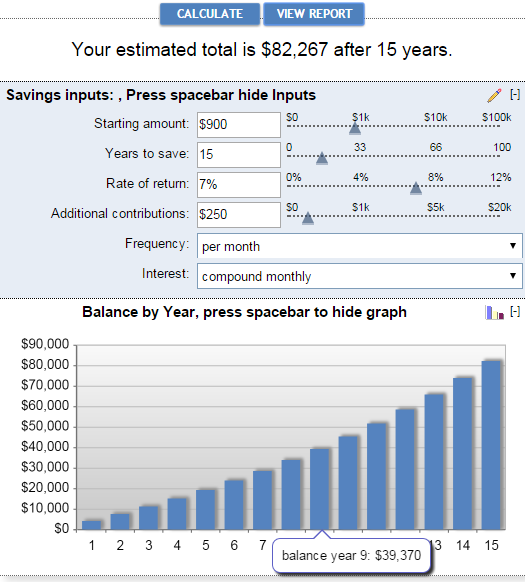

But when it comes to total retirement income you have more options. The compound interest calculator gives the total investment wealth gained and maturity value both in number and in graphical format. See the Methodology link below for additional details.

Adjust your contributions or predicted investment performance to see the effect they have on your TFSA value. 2022 federal income tax calculator. Summary of using 529 plans for college expenses.

In contrast Roth IRA contributions are deposited using after-tax dollars and are not taxed when withdrawn during retirement. The earnings portion of non-qualified withdrawals is subject to federal income tax as well as an additional 10 penalty. The amount you contribute investment performance and when you retire are some factors that affect the future value of your RRSP.

Planning for retirement takes time and focus to get right. The current maximum annual allowable increase is 6500 a year. The primary goal of corporate finance is to maximize or increase shareholder value.

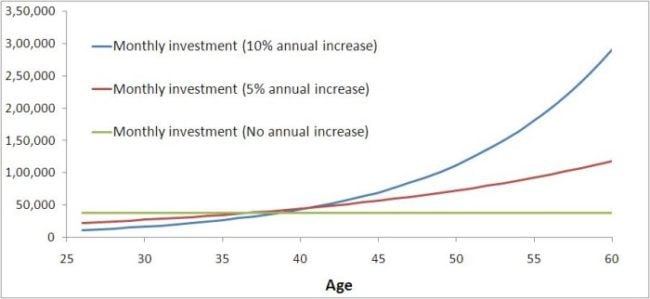

Use our free retirement calculator to determine your estimated retirement age and whether youre saving enough. Watchful spending and increasing investment corpus every year will also help in building wealth faster. Use this calculator to see how increasing your contributions to a 457 plan can affect your paycheck as well as your retirement.

It assumes the current salary and pension contributions will apply in full throughout the tax year. Benefits of Using a Payroll Calculator. Be sure to verify the maximum contribution rate allowable under your plan.

You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. This calculator will show you the average number of additional years a person can expect to live based only on the sex and date of birth you enter. Our TFSA calculator uses these inputs to estimate how much your TFSA could be worth in the future.

457 Plan Withdrawal Calculator. Use this calculator to help determine if converting your 457 plan account to a 457 Roth plan account is a good move for you. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Capital gains losses tax estimator. Actual investor performance may differ as a result of the investment date the date of reinvestment and dividend withholding tax. Enroll Now or Increase Contributions.

The sooner you start making a retirement plan the more money you can save and invest for the long term. This total would include all the purchase options available. Salary receivedpension contributions paid are distributed uniformly through the tax year.

Federal tax-free treatment of 529 plans applies to any funds withdrawn to cover qualified higher education expenses QHEE or K-12 tuition. Use Forbes Advisors. Faster accrual additional pension and buying out the early reduction factor.

Make regular contributions to the existing investment to add potential to compounding. There is an annual limit on increasing your pension by making additional contributions. A 1000 investment.

Investment performance will depend on the growth in the underlying assets which will be influenced. Our RRSP calculator uses these inputs to estimate how much your RRSP could be worth in the future. Corporate finance is the area of finance that deals with sources of funding the capital structure of corporations the actions that managers take to increase the value of the firm to the shareholders and the tools and analysis used to allocate financial resources.

Super Investment Management Pty Limited ABN 86 079 706 657 AFSL 240004 a wholly owned company of Rest manages some of the Funds investments. Many people choose to withdraw only from their investment contributions and leave the employer-funded. Adjust your contributions or predicted investment performance to see the effect they have on your RRSP value.

Please see how to read these results below. You can increase your pension benefit by increasing your years of service or your income. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance.

Use our retirement calculator to see how much you might save by the time you retire based on conservative historic investment performance. How much self-employment tax will I pay. The calculator will not consider a situation where employment has started or ceased during the year.

All figures take account of inflation and show the buying power of your pension in todays money. How much of my social security benefit may be taxed.

Excel Investment Calculator Myexcelonline

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Daily Compound Interest Formula Calculator Excel Template

Step Up Sip Calculator

Walletburst Compound Interest Calculator With Monthly Contributions

Investment Calculator Learn Investment Formula

Compound Interest Formula And Calculator For Excel

Increased Contribution Impact Calculator Agfinancial

What Is The Best Roth Ira Calculator District Capital Management

Tsp Contributions And Funds Youtube

Walletburst Compound Interest Calculator With Monthly Contributions

Free 401k Calculator For Excel Calculate Your 401k Savings

Customizable 401k Calculator And Retirement Analysis Template

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula And Calculator For Excel